New Homes 2022 outlook

By Craig Hall, Director of New Homes Financial Services, LSL Financial Services

Demand vs Supply

2022 looks set to be another steady year for the new homes sector, with demand continuing to remain strong, with many home movers in a ‘race for space’ following a reassessment of their housing needs and first time buyers looking to take advantage of the Governments Help to Buy scheme prior to the schemes closure in March 2023. This at a time when a number of estate agents are reporting the number of available resale properties per branch at record low levels, further highlighting the imbalance between demand and supply.

Housebuilding

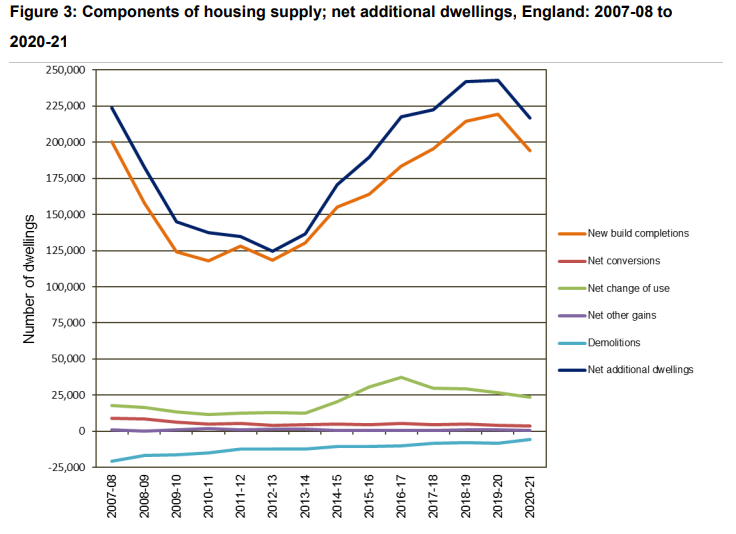

The house building industry has continued to recover well by in large, however we are not quite back to pre-pandemic construction levels yet, due to the challenges experienced during 2021 with materials supply chains, rising costs and a shortage of skilled labour. The Government’s latest housing supply statistics were published on the 25th November, confirming the annual housing supply in England amounted to 216,490 net additional dwellings in 2020-21, down 11% on 2019-20 (see figure 3).

Mortgage Finance & Government Support

The latest Help to Buy (England) statistics confirm that 339,347 homes have been purchased via the scheme since April 2013, with over 60,000 in the year to 30th June 2021. The scheme has seen annual completions exceed 40,000 since 2017. For some homebuyers the scheme has enabled them to buy a bigger home then they may otherwise have been able to afford, resulting in them ‘skipping’ a level of the housing ladder, however for others it was a key enabler to taking the first home ownership step.

During our recent New Build Forum (Nov. 2021), Knight Frank suggested that the removal of the Help to Buy scheme could leave a void for circa 30% of new homes transactions – key for mortgage advisers is understanding the potential options that will remain for homebuyers with a small deposit such as;

- Government Schemes – Shared Ownership and the new First Homes Scheme – for information on the full range of Government Schemes click here

- Deposit Unlock – high LTV New Build scheme (90-95% LTV) Nationwide Building Society and Newcastle Building Society – more lenders due to be announced this year

- Family Assist Mortgages – see individual lenders’ criteria – Joint Borrower Sole Proprietor, Guarantor, Inter-generational lending etc.

- Bank of Mum and Dad – Gifted Deposits; Parents or grandparents releasing equity to assist with raising a deposit

- Private Equity loan schemes – LSL are currently in discussion with a number of new partners – look out for more information coming soon

Green Agenda & Sustainable Homes

It is really encouraging to see the mortgage sector embracing green, sustainability and energy efficiency, which has seen an increase in green mortgages. The Green Finance Institute has launched a Green Mortgage Hub which collates all publicly available information on green deals into an interactive table.

It aims to encourage lenders to enter the green mortgage market and to provide a “trusted source of information” for mortgage intermediaries and various key stakeholders.

Developers are currently working towards the requirements of the Future Homes Standard, ensuring that new homes built from 2025 will produce with a reduction of 75-80% less carbon emissions than under current regulations. Key will be understanding how the Government will support the energy efficiency improvements for the existing housing stock and the vital role lenders and independent mortgage advisers will play with recommending the most appropriate mortgage or product.