GOING FURTHER… ITS IN OUR DNA!

LAST CHANCE TO VOTE!

Voting for The British Mortgage Awards 2021 closes at 5pm today, Friday 4th June!

Click here for a reminder of what we have delivered in the last 12 months to support you and your business.

There are also a number of Broker categories, which you may be eligible to enter… nominate someone in your firm to be in with a chance of winning, and being recognised for all of your hard work.

NEW BLOG OUT NOW!

View our latest blog by Liza Campion, Head of Corporate Accounts at Kent Reliance For Intermediaries as she places a spotlight on Shared Ownership. Find out how Shared Ownership could be the solution, what you need to consider and how Kent Reliance can help your customers.

Ami urges brokers to engage PI insurance amid mis-selling claims

The Association of Mortgage Intermediaries has called the dismissal of legal cases against mortgage firms for the supposed mis-selling of interest only mortgages “encouraging.”

Ami says firms should engage their PI insurer early and that those who are not members of the association should consider joining to gain support on these critical matters.

Several cases against mortgage firms relating to interest-only products sold between 2004 and 2007 have recently been dismissed, including claims against brokers SPF Private Clients and Albany Park.

However, Ami says a number of firms still face court claims and action in relation to this alleged mis-selling, which is expensive to defend and has been a factor in escalating PII excesses and premiums.

Ami chief executive Robert Sinclair says: “These decisions strike out the cases as being time barred. In addition, the courts in delivering their judgements have also considered many of the substantive issues under review.

“These broadly have reduced the amounts of claim substantially, established that they have limited or no merit, set out that the costs of court time outweigh potential benefit and challenge the quality of both the claimant evidence and expert witness work.”

Sinclair says Ami continues to work with members to provide information and support to defend the cases, where appropriate in a “fair and robust manner.”

Taken from https://www.mortgagestrategy.co.uk/news/ami-urges-brokers-to-engage-pi-insurance-amid-mis-selling-claims/

Removal of Coronavirus Hub

At NatWest Intermediary Solutions we appreciate that there is currently a heightened interest in the status of the UK economy, as we all seek to understand just what the future may hold and what impact this may have on the mortgage market.

To help provide you with some insight on economy, we have been working alongside our expert Economist Team to produce a new ‘Economic Hub’ for you to utilise. The hub will be updated every month and provide you with a regular overview of the key themes impacting our economy.

For brokers who have attended our regional events in recent years, you will know that the content our Economist Team produce is timely and thought-provoking, and when assessing feedback of the regional events the economist content has always scored highly.

Removal of Coronavirus Hub

From the outset of the Coronavirus outbreak last year, we created a specific ‘Coronavirus Hub’ where we housed all the updates to affected policies and processes. We have worked hard to ensure that all the relevant content on the Coronavirus Hub has now been amalgamated into our A-Z of Lending Criteria page and Self Employed Hub.

Because of this, we have made the decision to remove the Coronavirus Hub, and will focus as we did prior to the outbreak of updating the A-Z of Lending Criteria page with all our criteria updates.

Mansfield reduces rates and increases maximum LTV on holiday lets

Mansfield Building Society has launched two new holiday let mortgages up to 70% LTV to coincide with this year’s rise in staycations.

The new products, comprising a five year fixed rate and a three year discounted rate, are available across England and Wales. For affordability, The Mansfield takes an annual average of 70% of the low, mid and high season rental income, after agent letting fees, when assessing the Interest Rate Coverage Ratio and the Society’s individual approach to lending allows it to consider background or personal wealth (Top Slicing) as part of the affordability assessment.

Head of Mortgage Sales, Andy Alvarez, said that The Mansfield was well-placed to help new and existing landlords operating in the Holiday Let space:

“As we head towards a summer with most people looking to holiday in the UK this year, the popularity of staycations is likely to increase demand in the holiday let sector. For landlords already operating in this sector looking to expand their portfolio or for those considering their first holiday let, our flexible approach has a lot to offer.

Whether it’s slightly unusual property types, offering real character, or quirky circumstances that still represent common sense opportunities, we can help brokers and their clients unlock their potential and we’re really looking forward to increasing our support for this market.”

TMA UPCOMING EVENTS

GI HiiT Session

Friday 11th June

Virtual Workshop

Wednesday 23rd June

Protection HiiT Series

30th June

20th July

21st September

CLICK HERE

QUERY OF THE WEEK

Do you have a case that you can’t be place? Take a look at our query of the week to find out how TMA supported a broker with a niche case:

Q – Are there any lenders who consider portfolio landlords that do not meet the stress test required on their portfolio of properties after failing a BTL mortgage application?

A – In this instance TMA have several lenders on panel that don’t stress test the background portfolio.

Please give our broker support desk a call on 0330 303 0236 for more information.

High Yields Fuel Appetite for Competitive HMO Products – Latest Market Data

Here at Foundation Home Loans, we’re experiencing a surge in interest from landlords who are looking to diversify their portfolios. And this is especially apparent when it comes to HMO’s.

Higher rental yields have certainly attracted landlords towards HMOs in the past and with an increasing number of properties being built or converted which provide comfortable, cost-effective solutions for tenants of all ages, HMOs will continue to prove attractive.

The appeal of such yields was further highlighted in our recent research with nearly 900 landlords in conjunction with BVA BDRC, which took place between March and April this year, which suggested that HMO lettings continue to generate significantly higher average rental yields compared to other property types (7.5%)

Breaking this down, individual units within flat blocks and bungalows were reported to generate the lowest average rental yields.

To meet the ongoing demand for HMOs, we have recently launched (May 2021) new standard (up to six occupants) and large HMO/MUB (over six occupants) five-year fixed rate mortgages at 75% LTV

ICR is calculated at pay rate on 5-year fixes at Foundation, and these come with a flat £1,495 fee so should appeal to those landlords who want larger-value, higher-yielding properties without the initial cost of a percentage fee. Each product is available to individual landlords as well as Limited Companies.

Limited company applicant? Try our calculator for stress testing.

So, if you have landlord clients who may be looking to add an HMO to their portfolio or refinance an existing HMO property, then why not speak to our team to see how our new product range might work for them.

Claims and COVID

Critical illness claims are one of the many things Covid has impacted. Read Scott Cadger’s latest article detailing the effects, and highlighting the ongoing value that Protection brings.

See who’s interested in servicing interest and why

More lifetime mortgages offer the interest serviced option and in 2020, 17% of Just For You Lifetime Mortgage clients selected it, an increase from 13% in 2019.

Our new analysis shows what they look like, where they are and why they chose a lifetime mortgage.

Has a case got you scratching your head? Talk to the KRFI experts

On Tuesday 8 June between 10.30am and 12.30pm, you’ll be able to speak directly to Kent Reliance for Intermediaries’ Group Underwriting Director, Dawn Mirfin and Group Head of Underwriting, Craig Richardson on Live Chat.

Whether you need help with a 10-bed HMO case, a first-time buyer looking to get onto the property ladder, or anything in between, this could be your chance to get the answers you need to solve your next case.

Schedule it in your diary now and save the following link to take you direct to the page on 8 June.

Rent A Room mortgages move back in

Bath Building Society will now let customers use rental income from a spare bedroom to increase borrowing capacity with the relaunched Rent A Room mortgage.

What if your client has found the ideal home, but their income isn’t quite enough to get the mortgage they need? If the property has a spare bedroom, this could be the answer. If your client is going to rent out the spare bedroom, we will consider rental income when assessing affordability.

“LiveMore, for less with fee-free June”

Specialist lender LiveMore Capital have today announced that they are removing the arrangement fees on all new mortgage applications across their entire product range.

Alison Pallett, Sales Director of LiveMore says “We are all about driving a better deal for more mature borrowers aged over 55 and this removal of the £995 to £1,395 product fees does exactly that. We hope that this change will assist our brokers in offering further choice to their customers needing interest only solutions, along with a fresh approach to affordability”.

LiveMore launched in the market last year on a mission to help order borrowers achieve their home ownership goals or use their property to live their latest life to the full.

Borrowing over 55 made easier webinar

LiveMore will be hosting their first webinar on Wednesday 16 June @ 12.30.

This will provide an overview of LiveMore and how they are shaking up the status quo when it comes to providing mortgages for borrowers aged over 55.

The webinar will also cover:

- What types of customers may be suitable?

- End of term

- Mortgage Prisoners

- Wealth/IHT planning

- IO needed without a fixed mortgage term and with no maximum age

- How their fresh look at affordability really does make a difference

- Accepting plausible income beyond normal retirement ages

- Vulnerable customers and how LiveMore can help support them

- Some real-life case studies to bring their differences to life.

The webinar will be hosted by:

Alison Pallett – Sales Director

Matt Kingston – Regional Sales Manager

There will be an opportunity to ask questions in their live Q&A at the end.

Attendees who attend the full session will be sent learning certificates which can be used for CPD.

Free registration link: https://livemorecapital.zoom.us/webinar/register/1416222149244/WN_E6w718pcQcK7VQfTJBdoDQ

WHY USE METRO BANK FOR INTEREST ONLY MORTGAGES?

Professional Mortgage Range enhancements

Professionals and higher earning customers can now benefit from our Interest Only Range combined with enhanced income multiple of 5.5 times earned income on mortgage applications where either all or part of the mortgage is to be arranged on interest only.

We now accept single applicants with earned income of £100k and above and joint applicants with combined earned income of £150k and above per annum (these customers are not required to be ‘qualified professionals’). In addition, we have added Surveyors, Engineers and Architects to our list of accepted professions.

Interest only ‘Core Range’ highlights

- The maximum age at the end of the mortgage term is 80 for all repayment types

- Debt consolidation now accepted

- Part & Part available up to 75% LTV when using sale of subject property – minimum property value of £600,000

- Maximum 85% LTV for Part & Part for all other interest only repayment strategies

- Second homes up to 85% LTV, 75% Interest Only sale of property acceptable – with no minimum property value – not available on Professional Range

- Minimum income of £50,000 required

- We require evidence of a suitable repayment strategy at the time of application

- New Affordability Calculator which calculates all Interest Only & Part and Part Mortgages, which you do not need to log on for

Doing the right thing for vulnerable customers.

Vulnerability is a complex issue with many underlying causes to think about, ranging from age and mental health to the impact of major events such as redundancy or bereavement.

By understanding the signs to look out for and knowing how to respond, we can make sure we are delivering the right support to every one of our customers.

- Understanding vulnerability

- Consumer vulnerability in the UK

- Recognising vulnerability

- Spotting the signs

- Responding to vulnerable customers once we have identified them

- Some general tips on talking to customers

- Useful information

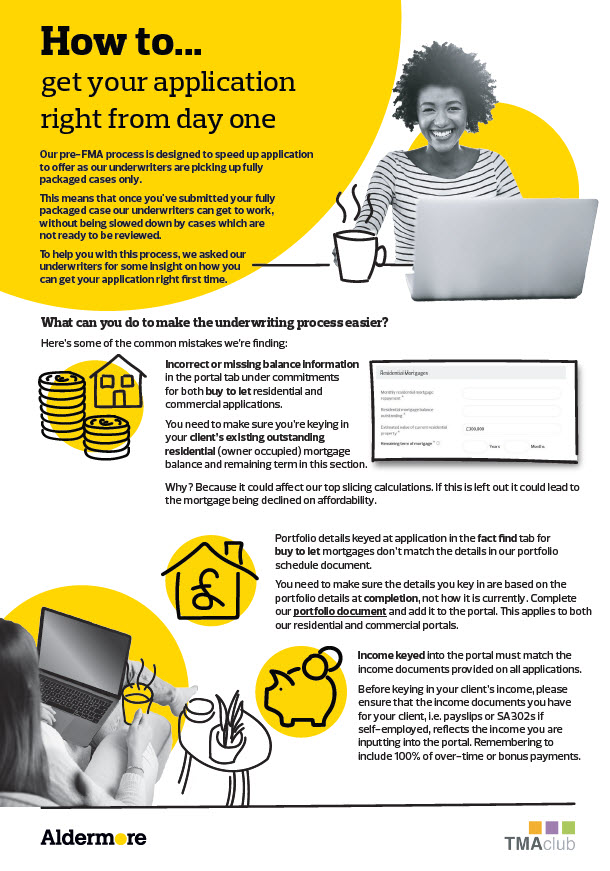

‘How To’ guide for packaging a case right first time

Specialist Lending by its very nature deals with cases that can be more complicated than average, so what can you do to help make the application process easier and more efficient for you and our Underwriters, and get from Application to Offer as quickly and efficiently as possible?

At Aldermore our pre-FMA process has been designed to speed up these timescales as our underwriters will be picking up fully packaged cases only – once you’ve submitted your fully packaged case our underwriters can get to work without being slowed down by cases which are not ready to be reviewed.

This handy ‘How To’ guide covers all the bases that you need to know to ensure your case gets off to a flying start and is submitted right first time.

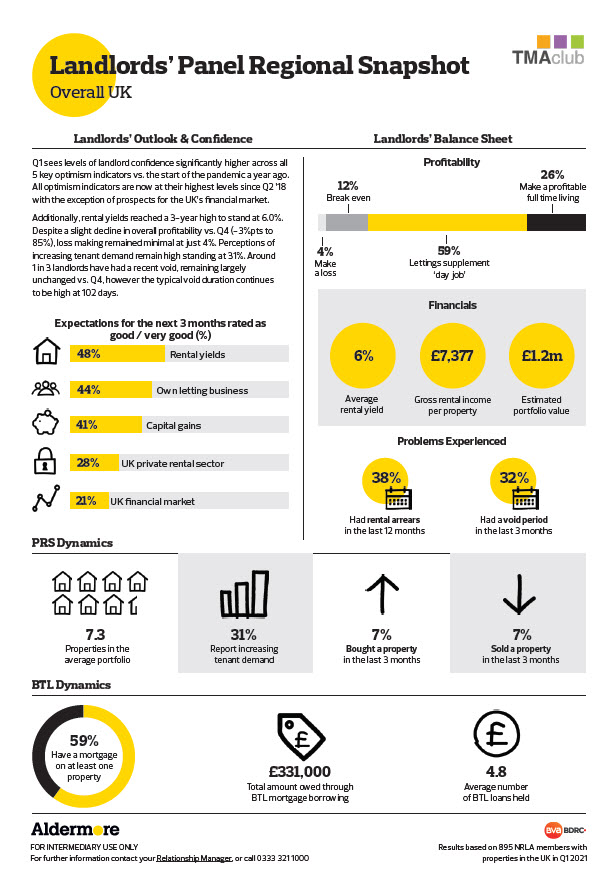

Landlords’ Panel Regional Snapshot

Across the UK, landlords are reporting they’re at their most optimistic and confident since 2018 – rental yields have reached a 3yr high and just under a third are anticipating an increase in tenant demand. But the pandemic is still leaving it’s mark, with just under 40% of landlords surveyed reporting rental arrears in the last 12mths. How does this compare to your region? Watch this space for regionalised versions of this data soon.